Loading

Get Ftb 3885l 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ftb 3885l 2018 online

Filling out the Ftb 3885l 2018 form can be straightforward with the right guidance. This comprehensive guide will walk you through each step to ensure accurate completion for your taxation needs.

Follow the steps to fill out the Ftb 3885l 2018 online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

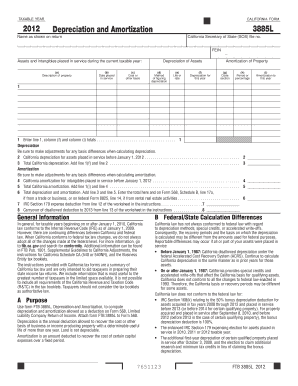

- Enter your name as it appears on the tax return in the designated field.

- Fill in the California Secretary of State (SOS) file number and Federal Employer Identification Number (FEIN) as required.

- For assets and intangibles placed in service during the current taxable year, complete the section by detailing the description of property, date placed in service, cost or other basis, method of figuring depreciation, life or rate, and depreciation for this year.

- If applicable, detail the amortization of property by entering the code section, period or percentage, and the amortization to this year.

- Ensure the totals from specified columns are entered correctly into lines as instructed, including line 1, column (f) and column (i) totals.

- Add total California depreciation from line 1(f) and any prior year depreciation entered on line 2.

- Calculate total California amortization, adding the totals from line 1(i) and line 4.

- Sum the total depreciation and amortization values and ensure to enter this total onto the respective forms (Form 568 or federal Form 8825) as indicated.

- Finally, review your completed form for accuracy and save your work. You may download, print, or share the form as needed.

Complete your tax documents online today to ensure timely and accurate filing.

You typically enter depreciation for rental property on Schedule E of your tax return. This report helps track income and expenses related to the rental, including the depreciation deductions allowed by the Ftb 3885l 2018. Properly reporting this can lead to significant financial benefits for property owners.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.