Loading

Get Merged Infile Credit Report - Arc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MERGED INFILE CREDIT REPORT - ARC online

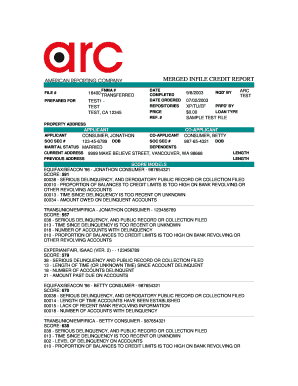

Filling out the MERGED INFILE CREDIT REPORT - ARC accurately is essential for your financial assessments. This guide provides clear, step-by-step instructions to help users complete the form online with confidence.

Follow the steps to fill out the MERGED INFILE CREDIT REPORT - ARC efficiently.

- Press the ‘Get Form’ button to access the form, enabling you to edit and complete it.

- Start by filling in the 'Prepared For' section with the name of the person or organization receiving the credit report. Ensure this matches their legal name.

- Include the property address on the form, ensuring correctness for accuracy in the lending process.

- Review the credit score information provided in separate sections for each applicant. Ensure the scores and key factors are visible and legible.

- Complete the section for inquiries from the last 90 days, including the details of credit pulls by any lenders.

- Check the creditor information, ensuring all accounts and balances are documented accurately.

- Once all sections are complete, save your changes. You may also download, print, or share the form as needed.

Start completing your MERGED INFILE CREDIT REPORT - ARC online today to streamline your loan application process.

An instant merge credit report provides a quick combination of credit data from multiple sources. This type of report enables lenders to access comprehensive credit information efficiently. While it can speed up the lending process, it also requires careful attention to ensure accuracy. Utilizing resources like US Legal Forms can help you manage your instant merge credit report effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.