Loading

Get Form 2602

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 2602 online

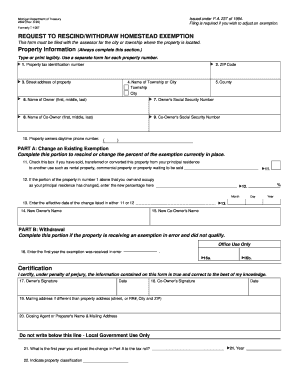

Filling out Form 2602 is crucial for adjusting a homestead exemption. This guide provides clear and supportive instructions for completing the form online, ensuring a smooth process for users with varying levels of experience.

Follow the steps to successfully complete Form 2602 online.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Complete the Property Information section, ensuring you fill in the property tax identification number, street address, city or township name, ZIP code, county, and the full name of the owner and co-owner.

- Input the social security numbers for both the owner and co-owner in the appropriate fields.

- Provide a daytime phone number for the property owner.

- In Part A, indicate if you have sold, transferred, or converted the property from your principal residence to another use by checking the box provided.

- If the percentage of your property that is used as a principal residence has changed, enter that new percentage in the designated field.

- Specify the effective date of the change as mentioned in the previous steps.

- In Part B, if applicable, state the first year the exemption was received in error.

- Complete the Certification section by providing the signatures of both the owner and co-owner as well as the date.

- If the mailing address differs from the property address, enter it in the designated area.

- Finally, input the name and mailing address of the closing agent or preparer.

- Once all fields are completed, save your changes, then download, print, or share the completed form as needed.

Start filling out your Form 2602 online today to adjust your exemption.

To obtain Form 26AS from your bank, request a copy from the bank branch you are associated with. Typically, the bank will provide you a form upon verifying your identity. Additionally, ensure that your tax records are accurate to facilitate a smooth retrieval of Form 26AS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.