Loading

Get Form 541 Es 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 541 Es 2020 online

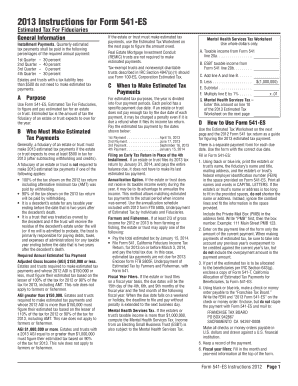

Filling out the Form 541 Es 2020 online is a crucial step for fiduciaries managing estates and trusts. This guide will assist you in understanding the components of the form and provide a clear, step-by-step approach to ensure accurate completion.

Follow the steps to complete the Form 541 Es 2020 online.

- Click the ‘Get Form’ button to access the form and open it in your preferred online document editor.

- Begin by entering the estate's or trust's name in capital letters, followed by the fiduciary's name and title, and the mailing address. Ensure to include the federal employer identification number (FEIN). If the name or address exceeds the space provided, do not abbreviate; instead, write clearly in the available space.

- On the payment line, specify only the amount of the current estimated tax payment. Include any adjustments for overpayments from previous years when calculating this amount, but do not include the overpayment itself in the payment amount.

- If the estimated tax is to be allocated to beneficiaries as per IRC Section 643(g), attach a copy of Form 541-T, Allocation of Estimated Tax Payments for Beneficiaries, along with your Form 541 Es 2020.

- Prepare a check or money order, making it payable to the 'Franchise Tax Board.' Include the FEIN and 'Form 541 Es 2020' in the memo section. Enclose the payment with Form 541 Es 2020, but do not staple it, and mail it to the specified address.

- Maintain a copy of your payment and the Form 541 Es 2020 for your records. If you are filing on a fiscal year basis, make sure to indicate the month and year-end at the top of the form.

- Finally, review your entries for accuracy. If everything is in order, save the completed form and payment information securely. You have the option to download, print, or share the form if necessary.

Complete your Form 541 Es 2020 online and ensure timely submission.

Related links form

You can download the 2020 tax forms, including Form 541 Es 2020, directly from the California Franchise Tax Board's website. They offer all necessary forms in PDF format for easy access. Additionally, you can find various tax preparation resources on their site, ensuring you have everything you need to complete your filing accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.