Get Transfer Of Ownership/change Beneficiary/ Change Annuitant

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Transfer of Ownership/Change Beneficiary/Change Annuitant online

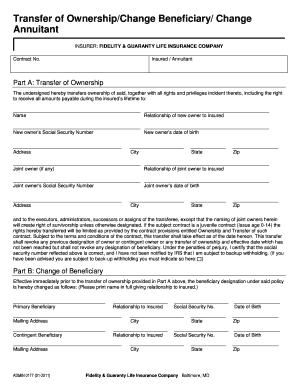

This guide provides a detailed and user-friendly approach to completing the Transfer of Ownership/Change Beneficiary/Change Annuitant form online. Whether you are transferring ownership, changing a beneficiary, or modifying an annuitant, following these steps will help ensure the process is straightforward and efficient.

Follow the steps to complete the form successfully.

- Click 'Get Form' button to obtain the form and open it in an editor.

- Begin by filling out Part A: Transfer of Ownership. Enter the name of the new owner along with their relationship to the insured. Provide the new owner's Social Security number, their date of birth, and complete their address, including city, state, and zip code.

- If applicable, include details for any joint owner. Fill in the joint owner's name, their relationship to the insured, Social Security number, date of birth, and address information.

- Proceed to Part B: Change of Beneficiary. Designate the primary beneficiary by providing their full name, relationship to the insured, and mailing address. Optionally, fill out the contingent beneficiary's information in the same manner.

- In Part C: Change of Annuitant, specify the new annuitant’s name, Social Security number, and mailing address. Provide their date of birth and a daytime phone number. Be sure to include the reason for this change.

- Review the important notice section to confirm understanding of signature requirements, especially if the policy is owned by a corporation or partnership. Complete necessary signatures from the current owner(s) and new owner(s).

- Finally, make sure all information is correct before saving changes. You can downloд, print or share the completed form as necessary.

Complete your Transfer of Ownership/Change Beneficiary/Change Annuitant form online today.

The annuitant and the beneficiary serve different roles in an annuity contract. The annuitant is the person whose life the annuity is based on, while the beneficiary receives the benefits upon the annuitant's death. Understanding these distinctions is crucial when considering the transfer of ownership, change of beneficiary, or change in annuitant. USLegalForms offers resources to clarify these roles and assist you in managing your annuity effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.