Loading

Get Tax Receipt Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Receipt Form online

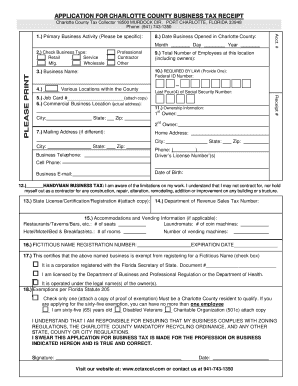

Completing the Tax Receipt Form online can streamline the application process for your business in Charlotte County. This guide will help you navigate each section of the form to ensure accurate and timely submission.

Follow the steps to successfully fill out the Tax Receipt Form online.

- Click ‘Get Form’ button to access the Tax Receipt Form and open it in your preferred editor.

- Fill in the business name section with the official name of your business. If you're using a fictitious name, ensure you have registered it with the state.

- Indicate the type of business by selecting the appropriate checkbox under the 'Check Business Type' section.

- Provide the date when your business opened in Charlotte County, including the month, day, and year.

- Input the total number of employees at your business location, including owners.

- Complete your commercial business location with the actual address where your business operates.

- If your mailing address differs from your business location, include that information in the designated section.

- Enter the required federal ID number or the last four digits of your Social Security number.

- Provide ownership information, including the owner's name, home address, and contact details. Make sure it's a physical address, not a P.O. box.

- If applicable, attach any required copies, such as a driver’s license or proof of exemptions for certain categories.

- Review all parts of the form for accuracy and completeness to avoid rejection.

- Finally, save your changes and choose to download, print, or share the completed form as necessary.

Complete your Tax Receipt Form online today to ensure your business complies with local regulations.

To write a receipt for tax purposes, start with the issuing party's information, including the business name and address. Clearly indicate the purpose of the payment, the amount, and the payment method. Labeling the receipt as a Tax Receipt Form helps clarify its purpose to both parties involved. Retaining such a document is vital for accurate tax reporting.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.