Loading

Get Crystal Reports 1099 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Crystal Reports 1099 Form online

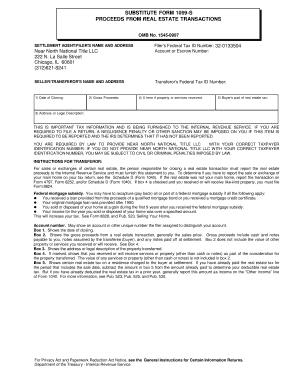

Filling out the Crystal Reports 1099 Form online is a crucial step in reporting proceeds from real estate transactions. This guide will provide clear and concise instructions to help you complete the process with confidence.

Follow the steps to fill out the form accurately.

- Press the ‘Get Form’ button to obtain the Crystal Reports 1099 Form and open it in the editor.

- Enter the date of closing in Box 1. This is the date when the transaction was finalized.

- Fill in Box 2 with the gross proceeds from the real estate transaction. This generally reflects the sales price and should include cash and any notes payable to you.

- Provide the address or legal description of the property in Box 3. This appears to ensure clarity on the specific real estate involved.

- If applicable, check Box 4 to indicate that you have received or will receive services or property as part of the transaction.

- In Box 5, input the part of the real estate tax charged to the buyer at settlement. If you have already paid the tax for the period, subtract this amount from what you’ve paid.

- Verify that all fields are filled out correctly before finishing. Make sure your identification numbers are accurate.

- Once all information is complete, you can save changes, download the form, print it, or share it as needed.

Complete your documents online efficiently and accurately to ensure compliance.

Receiving a Crystal Reports 1099 Form can impact your taxes, as it indicates additional income you must report. This may increase your overall tax liability depending on your total income and deductible expenses. It's important to track expenses related to that income to minimize your tax burden. By using tools like USLegalForms, you can manage this process more effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.