Loading

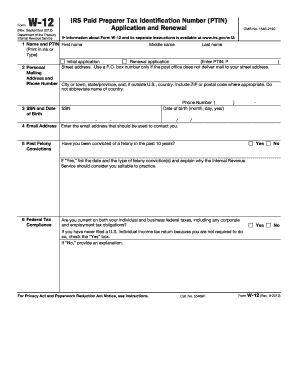

Get Form W-12 (revised November 2011) - Internal Revenue Service - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form W-12 (Revised November 2011) - Internal Revenue Service - Irs online

Filling out Form W-12 is essential for individuals seeking to apply for or renew their Paid Preparer Tax Identification Number (PTIN) with the IRS. This guide provides step-by-step instructions on how to complete the form accurately and efficiently online.

Follow the steps to complete Form W-12 online.

- Press the ‘Get Form’ button to retrieve the form and access it in your preferred online editor.

- Begin with section 1 by entering your first name, middle name, and last name. Indicate whether this is an initial application or a renewal application by selecting the appropriate option.

- In section 2, provide your personal mailing address, including your street address, city or town, and ZIP code. Ensure you spell out the name of the country if you are outside the U.S.

- Complete section 3 by entering your Social Security Number (SSN) and date of birth, ensuring the date is formatted correctly.

- Provide your email address in section 4 to receive important communications regarding your application.

- In section 5, answer whether you have any past felony convictions. If yes, detail the convictions and why you believe you are suitable to practice.

- Section 6 asks about your compliance with federal taxes. Respond accurately and provide explanations if necessary.

- In section 7, check off your professional credentials by entering the state abbreviation and corresponding numbers for relevant licenses or certifications.

- If applicable, complete sections 8, 9, and 10 regarding your tax preparation activities and supervisory status. This is only necessary if you are not an attorney, CPA, or EA.

- Proceed to section 11 by providing business identification numbers if you are self-employed or a business owner.

- In section 12, include your business mailing address, ensuring all information is accurate.

- For section 13, optionally provide your business phone number.

- Enter your business name and website address in section 14, if applicable.

- Section 15 requires the address of your last individual income tax return filed or, if you have never filed, check the corresponding box.

- Fill out section 16 by indicating your filing status and tax year if you filed a return.

- In section 17, determine the applicable fee for your application or renewal and indicate whether you want your PTIN valid for the current or next calendar year.

- Lastly, sign the form in the designated area, including the date of your signature.

- After reviewing your entries for accuracy, save your changes, and choose to download, print, or share the completed form as needed.

Complete your Form W-12 online today to ensure your PTIN application or renewal is processed promptly.

As of now, rumors about the IRS sending $3000 tax refunds in June 2025 are circulating. However, there is no official confirmation of such a program. Keep an eye on updates from the IRS for accurate information regarding tax refunds and consider filing your Form W-12 (Revised November 2011) - Internal Revenue Service - Irs to stay compliant and receive potential refunds timely.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.