Loading

Get Foren Xx

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Foren Xx online

Filling out the Foren Xx online can seem daunting, but with the right guidance, you can complete the process efficiently. This guide provides step-by-step instructions to help you navigate each section of the form with confidence.

Follow the steps to smoothly complete the Foren Xx online.

- Click 'Get Form' button to access the form and open it in the editor.

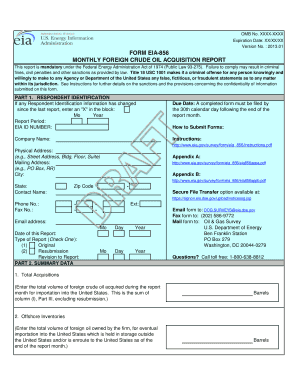

- Fill out Part 1: Respondent Identification. If any information has changed since your last report, mark an 'X' in the specified block. Provide the report period, EIA ID number, company name, physical address, mailing address, city, state, zip code, contact name, phone number, fax number, email address, and date of the report. Select the type of report by checking either 'Original' or 'Resubmission.'

- Complete Part 2: Summary Data. Enter the total acquisitions, which is the volume of foreign crude oil acquired during the report month, and the offshore inventories, which denote the volume of foreign oil held for eventual importation into the United States.

- Proceed to Part 3: Transactions. Fill in the EIA ID number and detail the transactions by providing the transaction number, type of action, country, crude code, crude type, gravity, loading date, port of loading, port of landing, and destination. Include comments if necessary to explain any variations in the data reported.

- Continue entering the volume acquired, acquisition price, other costs, landed cost, and credit days. Lastly, provide the name of the vendor associated with the transactions.

- After filling out all sections, review the form for accuracy. You can save changes, download, print, or share the completed form as needed.

Complete your Foren Xx submission online today to ensure compliance and accuracy.

The xx's album is called I See You, which was released in 2017. This album exemplifies the journey and growth of Foren Xx as artists, combining their distinctive sound with new influences. It represents a maturation of their artistic vision, reflecting personal experiences that resonate with many listeners. Dive into I See You and experience the evolution of Foren Xx.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.