Loading

Get Macon County Occupancy Tax Report

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Macon County Occupancy Tax Report online

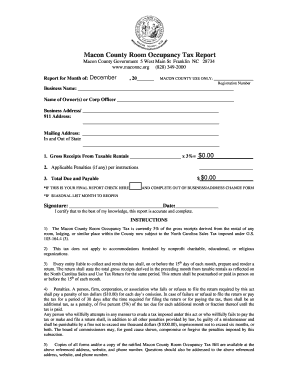

The Macon County Occupancy Tax Report is essential for businesses collecting occupancy taxes from rental activities within Macon County. This guide will help you through the steps required to accurately complete and submit the report online.

Follow the steps to fill out your report effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Indicate the month for which you are reporting in the section labeled 'Report for Month of:'. Fill in the blank with the appropriate month and year.

- Provide the registration number assigned to your business in the 'Macon County Use Only' section.

- Enter the name of your business in the 'Business Name' field.

- Fill in the name of the owner(s) or corporate officer in the designated area.

- Complete the business address, including the street, city, state, and zip code.

- In the '911 Address' section, provide the physical address used for emergency services.

- If your mailing address is different from your business address, enter it in the 'Mailing Address' field.

- Input your gross receipts from taxable rentals in the appropriate field and calculate the occupancy tax due by multiplying the gross receipts by 3%. Enter this amount in the designated box.

- If applicable, include any penalties as instructed. This section should be filled out based on the current guidelines.

- Add the total tax due in the 'Total Due and Payable' section.

- If this submission represents your final report, check the corresponding box and ensure to complete the out-of-business/change of address form.

- If you are a seasonal business, indicate the month you plan to reopen in the designated area.

- Sign and date the report. Your signature certifies that the report is accurate and complete.

- Review your report for accuracy, save changes, then download, print, or share the form as needed.

Complete your Macon County Occupancy Tax Report online to ensure compliance and avoid penalties.

Yes, property taxes in North Carolina are considered public records, allowing individuals to access information. This includes details about property ownership and tax assessments. The Macon County Occupancy Tax Report may serve as a useful resource for understanding various tax obligations within the county, including property taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.