Loading

Get Irs Form M 8453 2012 For Electronic Filing

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

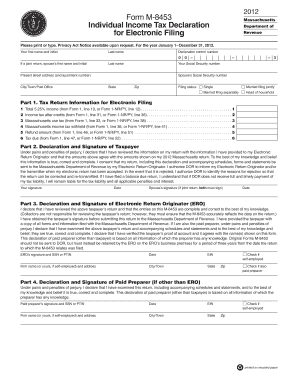

How to fill out the IRS Form M 8453 2012 for electronic filing online

Completing the IRS Form M 8453 is a crucial step in the process of filing your income tax electronically. This guide aims to provide clear and detailed instructions to help you navigate each section of the form effectively.

Follow the steps to complete the IRS Form M 8453 2012 for electronic filing.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in your first name and initial, followed by your last name. If you are filing jointly, include your spouse’s first name and initial, and their last name.

- Enter your Social Security number and your spouse’s Social Security number if applicable.

- Provide your present street address, including any apartment number, followed by your city, state, and ZIP code.

- Select your filing status by checking the appropriate box: single, married filing jointly, married filing separately, or head of household.

- In Part 1, enter the total 5.25% income, income tax after credits, Massachusetts use tax, Massachusetts income tax withheld, refund amount, and tax due in the corresponding fields.

- Sign and date the declaration and signature section of the taxpayer. If you are filing a joint return, your spouse must also sign and date this section.

- In Part 3, if applicable, the Electronic Return Originator must sign and provide their Social Security number or Preparers Tax Identification Number (PTIN), date, EIN, and firm name.

- If there is a paid preparer (other than the ERO), they must fill out Part 4 with their signature, SSN or PTIN, date, EIN, firm name, and address.

- Review all entries on the form for accuracy and ensure that all required signatures are provided before submitting. Finally, you can save changes, download, print, or share the form as needed.

Complete your IRS Form M 8453 online today to ensure a smooth filing process!

Various reasons might prevent your tax return from being eligible for e-file. Common issues include filing specific forms that require paper submission, such as IRS Form M 8453 2012 for electronic filing. It is essential to review your tax situation and ensure all entries are accurate. If needed, U.S. Legal Forms can assist you in understanding any additional paperwork required.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.