Get 1099 Hc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1099 Hc online

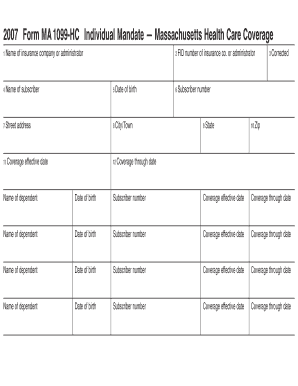

Understanding and completing the 1099 Hc form is essential for demonstrating your health care coverage for tax purposes in Massachusetts. This guide provides a clear, step-by-step approach to help you effortlessly navigate the online submission process.

Follow the steps to complete the 1099 Hc online efficiently.

- Press the ‘Get Form’ button to access the 1099 Hc and open it in the editor.

- Fill in the name of the insurance company or administrator in the designated field (box 1). This is the organization providing your health care coverage.

- Provide the name of the subscriber in box 4, which typically refers to the person who holds the insurance policy.

- Enter the subscriber's date of birth in box 5. Ensure the format is correct for online submission.

- Complete the subscriber’s street address in boxes 7 and the other relevant location fields like city/town (box 8) and state (box 9) for accurate identification.

- Indicate the coverage effective date in box 11 and the coverage through date, if applicable. This reflects the period during which the health insurance was active.

- Enter the FID number of the insurance company or administrator in box 12, ensuring that it is the correct identification number for tax reporting.

- If applicable, list any dependents by providing their names and dates of birth, along with the corresponding subscriber numbers and coverage dates for each dependent.

- Review all entered information for accuracy. Once the form is complete, you have the options to save changes, download, print, or share the form as necessary.

Complete your 1099 Hc and other documents online today for a smoother filing experience.

Get form

While both the 1099-HC and 1095-C forms provide details about healthcare coverage, they serve different purposes. The 1099-HC focuses on verifying health insurance coverage for Massachusetts residents, whereas the 1095-C, issued by employers, confirms that specific health coverage met the Affordable Care Act'srequirements. Understanding these distinctions helps you ensure proper filing for state and federal taxes. You can rely on platforms like USLegalForms to clarify any confusion.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.