Loading

Get Form Ar1000rc5

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Ar1000rc5 online

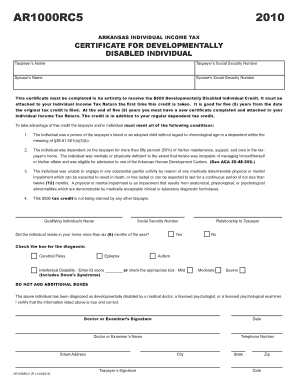

Filling out the Form Ar1000rc5 is essential for taxpayers seeking to claim the Developmentally Disabled Individual Credit. This guide provides clear steps to successfully complete the form online, ensuring a smooth submission process.

Follow the steps to fill out the Form Ar1000rc5 online effectively.

- Click the ‘Get Form’ button to access the form and open it in the online editor.

- Enter the taxpayer’s name and Social Security number in the designated fields. Ensure that these details are accurate, as they are critical for processing your tax credits.

- Provide the spouse's name and Social Security number if applicable. If there is no spouse, leave this section blank.

- Read the eligibility criteria carefully. Confirm that the individual for whom you are claiming the credit meets all conditions outlined, such as dependency status and disability criteria.

- Complete the section regarding the qualifying individual's name and Social Security number. Ensure that the information matches official records to avoid delays.

- Indicate whether the individual resided in your home for more than six months of the year by selecting 'Yes' or 'No.'

- Select the appropriate checkboxes for the diagnosis from the list provided: Cerebral Palsy, Epilepsy, Autism, or Intellectual Disability. If applicable, enter the IQ score for intellectual disability.

- Obtain the necessary signature from a medical doctor, licensed psychologist, or licensed psychological examiner, along with their name and telephone number for verification.

- Have the taxpayer sign and date the form at the bottom to certify that the information is true and correct.

- Once the form is completely filled out, save your changes. You may choose to download, print, or share the completed form as per your requirement.

Complete your Form Ar1000rc5 online today to take advantage of the Developmentally Disabled Individual Credit.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To receive your stimulus check, you typically need to fill out the appropriate tax form, which in Arkansas is the Form AR1000RC5. This form gathers necessary personal and income information to determine your eligibility. Consider browsing US Legal Forms for step-by-step guidance on completing this form.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.