Loading

Get Ira One-time Distribution Form - Lord Abbett And Co.

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRA One-Time Distribution Form - Lord Abbett And Co. online

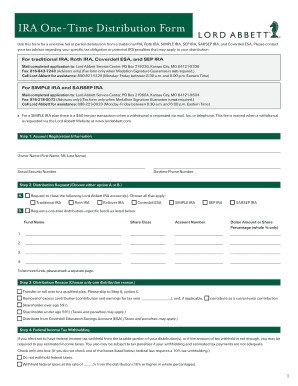

The IRA One-Time Distribution Form from Lord Abbett And Co. is essential for processing a one-time distribution from various IRA accounts. This guide will provide clear, step-by-step instructions to help you complete the form accurately online.

Follow the steps to successfully complete your IRA distribution form.

- Click ‘Get Form’ button to access the IRA One-Time Distribution Form and open it for editing.

- Provide your account registration information. Fill in your full name (first name, middle initial, and last name), Social Security number, and a daytime phone number where you can be reached.

- In the distribution request section, choose either Option A or B. If you are closing an account, check the relevant account types you wish to close. If you are requesting a one-time distribution, provide the specific funds' names, account numbers, share classes, and the dollar amount or percentage you wish to withdraw for each listed fund.

- Select a distribution reason from the options provided, ensuring to pick only one. This might include reasons such as a transfer to a qualified plan or age-related withdrawals.

- Complete the federal income tax withholding section. Choose whether to withhold federal taxes or not, and if opting to withhold, specify the percentage to be withheld from your distribution.

- If applicable, indicate your state income tax withholding preferences. You may need to check if your state has mandatory or optional withholding requirements and complete the additional amounts, if necessary.

- Choose your distribution services. You can opt to have a check mailed to you, have the funds directly deposited into your bank account, or choose to transfer the funds to another custodian or trustee. If you request a direct deposit, enter your bank account type, routing number, and account number.

- Provide your authorized signature along with the date to confirm that all information provided is accurate.

- If required, ensure to include a Medallion Signature Guarantee in the appropriate section, noting when it is necessary.

Complete your IRA One-Time Distribution Form online today for a smooth and efficient distribution process.

An IRA distribution request form is a document that you complete to withdraw funds from your Individual Retirement Account. The IRA One-Time Distribution Form - Lord Abbett And Co. serves this purpose by allowing you to specify the amount and type of withdrawal. Submitting this form initiates your request and streamlines the process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.