Get Dayton Ohio Dw 3 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dayton Ohio DW-3 Form online

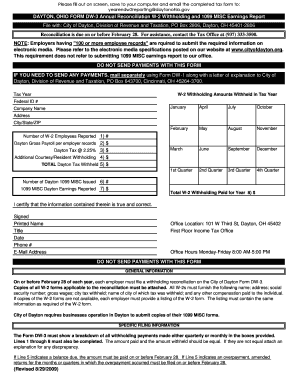

The Dayton Ohio DW-3 Form is an essential document for employers to report annual reconciliation of W-2 withholding and 1099 MISC earnings. This guide provides clear, step-by-step instructions to help users complete this form accurately online.

Follow the steps to fill out the Dayton Ohio DW-3 Form online:

- Click the ‘Get Form’ button to access the Dayton Ohio DW-3 Form and open it in your preferred editor.

- Begin completing the 'Tax Year' section by entering the appropriate year for the reconciliation.

- Fill in the 'Company Name' and 'Address' sections clearly, providing the full address, including city, state, and ZIP code.

- Input your 'Federal ID #' in the designated field to associate your business with the tax reporting.

- Record the number of W-2 employees reported by filling in 'Number of W-2 Employees Reported' with the accurate count.

- In 'Dayton Gross Payroll per employer records,' input the total payroll amount for your employees as applicable.

- Calculate the 'Dayton Tax @ 2.25%' based on the Dayton gross payroll amount and enter it in the designated field.

- If applicable, report any 'Additional Courtesy/Resident Withholding' amounts under the respective section.

- Ensure the 'TOTAL Dayton Tax Withheld' reflects the total of Dayton tax withholdings for the year.

- Report the 'Number of Dayton 1099 MISC Issued' and the '1099 MISC Dayton Earnings Reported' accurately.

- Complete the total W-2 withholding paid for the year in 'Total W-2 Withholding Paid for Year,' ensuring accurate totals.

- Sign the form by providing a printed name, title, date, phone number, and email address in the designated spaces.

- Review all the information completed in the form to ensure accuracy before finalizing.

- Once you are satisfied with the completed form, save the changes to your computer, then email the completed tax form to yearendw2reporting@daytonohio.gov.

Complete your forms online and ensure timely submission for compliance!

Filing the DW 3 in Ohio is a straightforward process. You will need to complete the form accurately, detailing your employment information and withholding details. Once filled out, you can submit it electronically through the Ohio Department of Taxation's portal, or you can print it and file it by mail. Don't forget, uslegalforms can provide you with an easy-to-use template for the Dayton Ohio DW 3 Form, ensuring you stay compliant.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.