Loading

Get Employer's Application Oath To Become A Self-insurer - Department Of ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Employer's Application Oath To Become A Self-insurer - Department Of Labor online

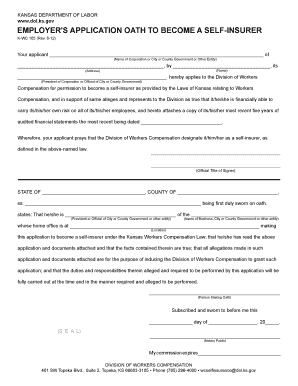

Filling out the Employer's Application Oath To Become A Self-insurer is a crucial step for entities seeking to assume their own workers' compensation risks. This guide provides detailed, step-by-step instructions to assist users in completing this form efficiently online.

Follow the steps to successfully complete your application.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the name of your corporation, city, county government, or other entity in the designated field.

- Fill in the complete address of your entity, ensuring accuracy to avoid processing delays.

- Identify the person who is authorized to sign the application by entering their name and official title in the provided sections.

- State your financial capability by confirming you can manage the risks for all employees. Attach the required five years of audited financial statements, with the latest statement clearly dated.

- Review the application to ensure that all details are accurately completed and that all necessary documents are attached for submission.

- Have the designated official swear to the truths in the application; this may involve completing a statement affirming the information provided and signing it.

- Submit your application along with any required attachments. Once everything is finalized, you may save changes, download, print, or share the form as needed.

Complete your Employer's Application Oath To Become A Self-insurer online today for a smoother process.

“Overall, the percentage of workers in self-insured plans has been bouncing around between 58% and 60% since 2010 but fell to 55% in 2022,” ing to the issue brief. “This occurred despite the increase in self-insurance among small and medium-sized companies because of the drop in self-insurance among large firms.”

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.