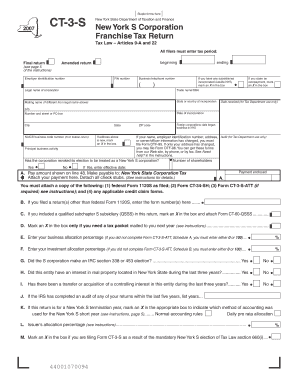

Get If You Filed A Return(s) Other Than Federal Form 1120s, Enter The Form Number(s) Here - Tax Ny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the If You Filed A Return(s) Other Than Federal Form 1120S, Enter The Form Number(s) Here - Tax NY online

This guide serves as a comprehensive resource for users needing assistance with filling out the section for 'If You Filed A Return(s) Other Than Federal Form 1120S' on the Tax NY form. The following instructions outline each step clearly to simplify the process.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to access the form and open it in the editor.

- Locate the section titled 'If you filed a return(s) other than federal Form 1120S, enter the form number(s) here.' This section may be found on the main page of the form. Carefully read any accompanying instructions that provide context for this section.

- In the designated area, enter the relevant form number(s) you have filed apart from the federal Form 1120S. Ensure that you accurately reflect the correct format for these numbers, as specified in the instructions.

- Review all entries made in this section for clarity and accuracy. Make sure that every form number is clearly listed and corresponds with the returns that have been submitted.

- Once completed, you can choose to save your changes, download, print, or share the form as needed for your records or further processing.

Take the next step towards completing your tax documentation online.

Yes, an S Corporation does file a federal tax return, specifically Form 1120S. This form reports the income, deductions, and credits of the S Corp, but it's important to note that the income is passed through to shareholders. If you filed a return(s) other than Federal Form 1120S, be sure to enter the form number(s) here - Tax NY. For an efficient filing process, US Legal Forms can provide the necessary documentation and support.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.