Loading

Get 2012 Ct 245 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 Ct 245 Form online

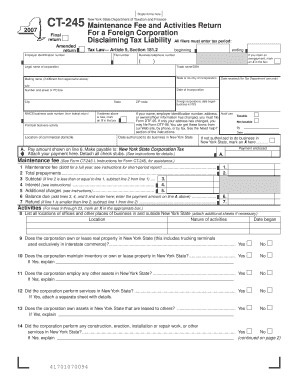

This guide provides clear and comprehensive instructions on how to complete the 2012 Ct 245 Form online. Whether you are new to filling out tax forms or looking to refresh your understanding, this guide will support you through each step of the process.

Follow the steps to accurately complete your form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the tax period in the space provided. This should include both the beginning and ending dates for the tax period you are reporting.

- Fill in your employer identification number and file number. These numbers are critical for identifying your filing.

- Provide the legal name of the corporation and the trade name, if applicable. If the mailing name differs from the legal name, include it as well.

- Indicate the state or country of incorporation and provide the full address, including the street number, city, state, and ZIP code. If the address has changed, check the appropriate box.

- Next, provide the NAICS business code number and the principal business activity, explaining what your corporation primarily does.

- List the location of commercial domicile and all locations of offices and other places of business inside and outside New York State. Attach additional sheets if necessary.

- Answer the series of questions concerning property and activities in New York State, ensuring to provide an explanation for any 'Yes' responses.

- Review the payment details, which include the maintenance fee. Make sure to attach your payment if you owe any.

- Finally, certify your return with the signature of the authorized person and document the signature of the individual preparing the return. Ensure to provide the date and any relevant identification numbers.

- After completing the form, save all changes, and consider downloading or printing a copy for your records. You can also share the completed form as necessary.

Complete your documents online today for a smoother filing process.

Filing a C Corp tax return involves completing Form 1120 and including all relevant income, expenses, and deductions. Gather your financial information meticulously and follow the IRS guidelines closely. If you want assistance with the process, including elements related to the 2012 Ct 245 Form, US Legal Forms can provide valuable support.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.