Loading

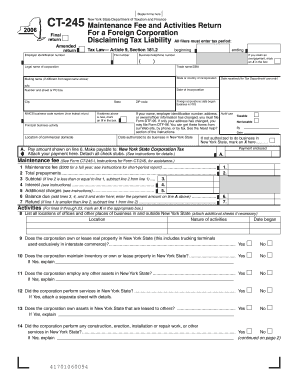

Get Maintenance Fee (see Form Ct-245-i, Instructions For Form Ct-245, For Assistance - Tax Ny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the maintenance fee (See Form CT-245-I, Instructions For Form CT-245, For Assistance - Tax Ny online

This guide will assist you in completing the Maintenance Fee form CT-245 accurately and efficiently. Designed for a broad audience, these instructions aim to clarify each section of the form and provide the necessary information needed to successfully fulfill your tax obligations.

Follow the steps to accurately complete your maintenance fee form.

- Press the ‘Get Form’ button to obtain the form and display it in your editor.

- Begin filling out the form by entering the appropriate tax period in the designated section. Ensure that all dates reflect the correct beginning and ending of your reporting period.

- Provide your employer identification number and file number where indicated. This information is essential for the processing of your return.

- In the section labeled 'Legal name of corporation,' enter the full registered name of your business. If applicable, include the trade name or doing business as (DBA).

- Fill out the mailing name and address, making sure they match the legal name when applicable. Include the state or country of incorporation.

- Declare your principal business activity and the location of your commercial domicile.

- If your address has changed, mark the appropriate box. This includes any changes in employer identification number or officer information.

- Complete the payment section. Enter the maintenance fee, which totals $300 for a full year, along with any applicable prepayments and additional charges. Sum these to identify your balance.

- In the activities section labeled from lines 9 through 23, mark either ‘Yes’ or ‘No’ for the relevant questions. Provide required explanations as necessary. Also, attach any sheets detailing your activities if the space provided is insufficient.

- Before finalizing, ensure to include your signature and the date, certifying that the information provided is accurate.

- Finally, you can save your changes, download, print, or share the form as needed.

Start completing your maintenance fee form online now.

In most cases, co-op maintenance fees are not tax deductible for personal residents. However, deductions may apply if the fees relate to a business aspect of the property. Be sure to check the specific details and guidelines surrounding these fees in the Maintenance Fee (See Form CT-245-I, Instructions For Form CT-245, For Assistance - Tax Ny).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.