Get Form Nyc 1127 2006

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form NYC 1127 2006 online

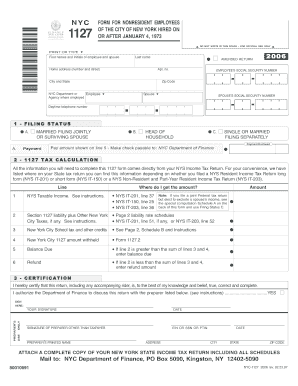

Filling out Form NYC 1127 2006 online can be a straightforward process with the right guidance. This form is specifically for nonresident employees of the City of New York who were hired on or after January 4, 1973, and ensures compliance with the applicable tax regulations.

Follow the steps to complete the Form NYC 1127 2006 online

- Press the ‘Get Form’ button to obtain the form and open it for editing.

- Complete the personal information section. Include your first names, initials, last name, home address, and contact details such as the daytime telephone number.

- Indicate your filing status by selecting the appropriate box. Choose from options such as married filing jointly, head of household, or single.

- Proceed to Section 2 for tax calculation. Refer to your New York State Income Tax Return to locate necessary amounts for completion, inputting them accurately into the provided fields.

- In the certification section, affirm that the details provided are true and complete. Additionally, authorize the Department of Finance to discuss your return with your preparer if applicable.

- Finally, review your entire form for accuracy. Save changes, and choose to download, print, or share the completed form as necessitated.

Start completing your Form NYC 1127 2006 online today to ensure compliance and avoid penalties.

To claim your New York State sales tax back, you will typically complete the appropriate forms, including Form NYC 1127 2006, if applicable. The process involves documenting your purchases and ensuring you have the receipts to support your claim. Using trusted resources and tax professionals can simplify this process for you. Staying organized will aid your claim in getting processed promptly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.