Loading

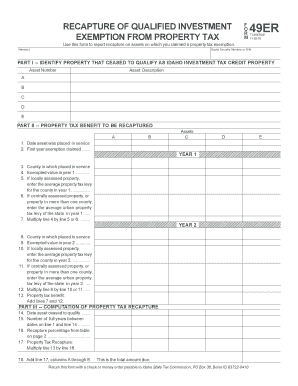

Get Recapture Of Qualified Investment Exemption From Property Tax 49er

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Recapture Of Qualified Investment Exemption From Property Tax 49er online

This guide provides step-by-step instructions on completing the Recapture Of Qualified Investment Exemption From Property Tax 49er form online. By following these clear and supportive directions, you will be able to navigate the form with ease and ensure all necessary information is properly submitted.

Follow the steps to complete your form successfully.

- Click ‘Get Form’ button to access the form and open it in your preferred online editor.

- In Part I, identify the property that no longer qualifies for the Idaho Investment Tax Credit. Enter the asset number and description in the appropriate fields.

- Proceed to Part II and complete each section related to the property tax benefit to be recaptured. For Line 1, input the date the asset was first placed in service.

- For Line 2, indicate the first year in which the property tax exemption was claimed.

- For Line 3, enter the Idaho county where the asset was placed in service. Ensure this matches information from your Form 49E.

- Input the exempted value of the asset for the year it was first claimed in Line 4. If unsure, contact the county assessor.

- Complete Line 5 if the asset was locally assessed by entering the average property tax levy for the county for that year.

- If the asset was centrally assessed or utilized in multiple counties, skip Line 5 and complete Line 6 with the average urban property tax levy.

- Repeat the data entry for the second year on Lines 8-12 in Part II if applicable.

- In Part III, enter the date the asset ceased to qualify on Line 14, followed by the number of full years for Line 15.

- Next, indicate the recapture percentage on Line 16 using the table provided.

- Multiply the property tax benefit from Line 13 by the recapture percentage you've recorded on Line 16 for Line 17.

- Summarize your total amount due in Line 18 and be sure to write 'Tax from attached' if you are adding amounts from separate schedules.

- Finally, review all information for accuracy before deciding to save changes, download, or print the completed form.

Complete your Recapture Of Qualified Investment Exemption From Property Tax 49er online today to ensure compliance and avoid penalties.

To obtain the exemption for a property, you must be its owner or co-owner (or a purchaser named in a contract of sale), and you must live in the property as your principal place of residence. You must also file the appropriate exemption claim form with the Assessor.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.