Loading

Get W9 Workers Compensation

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W9 Workers Compensation online

Filling out the W9 Workers Compensation form online can seem daunting, but it is a straightforward process. This guide will walk you through each section of the form to ensure you complete it accurately and efficiently.

Follow the steps to fill out the W9 Workers Compensation form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

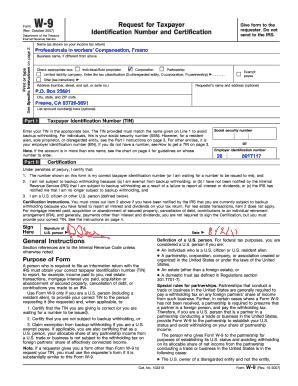

- In the first section, enter your name as it appears on your income tax return. If you are a sole proprietor, you may also include your business name on the designated line.

- Check the appropriate box to indicate your tax classification: Individual/Sole Proprietor, Corporation, Partnership, Limited Liability Company, or Other. If you select Limited Liability Company, specify the tax classification (D for disregarded entity, C for corporation, P for partnership) in the space provided.

- Fill in the address section with your current mailing address, including the street, city, state, and ZIP code.

- In Part I, you need to provide your Taxpayer Identification Number (TIN). For individuals, this is your Social Security Number (SSN). If you are a business entity, you should enter your Employer Identification Number (EIN). Ensure that the TIN matches the name entered in Part I to avoid backup withholding.

- In Part II, you will certify that the TIN you provided is correct. You need to sign and date the form. If you are subject to backup withholding, cross out the relevant item in the certification.

- Lastly, review all the information to confirm its accuracy. Once completed, users can save changes, download, print, or share the form as needed.

Complete your W9 Workers Compensation form online efficiently and ensure all your tax information is accurate.

In general, workers' compensation benefits are not taxable under the IRS. These payments are designed to support injured workers, and taxing them would diminish their purpose. However, if you have received other types of income alongside workers' compensation, it is essential to understand how these may affect your overall tax situation. For guidance, consider using resources from US Legal Forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.