Loading

Get Blank W8

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Blank W8 online

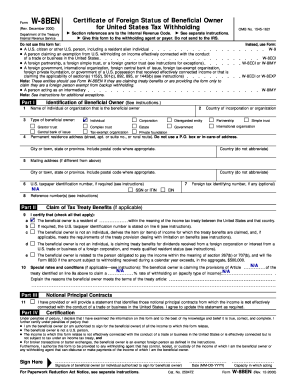

Filling out the Blank W8 is an essential step for non-U.S. persons seeking to establish their foreign status for tax purposes. This guide will walk you through the process of completing the form online, ensuring that every section is addressed clearly.

Follow the steps to complete the Blank W8 with ease.

- Click ‘Get Form’ button to access the Blank W8 and open it in your editing tool.

- Enter the name of the individual or organization that is the beneficial owner in the designated field.

- Select the type of beneficial owner from the available options, such as individual, corporation, or partnership.

- Provide the country of incorporation or organization where applicable.

- Fill in the permanent residence address. Ensure to include the city, state, and postal code, avoiding P.O. boxes.

- If the mailing address differs from the permanent residence, complete the additional address fields as well.

- If applicable, enter the U.S. taxpayer identification number, social security number (SSN), or individual taxpayer identification number (ITIN).

- Provide the foreign tax identifying number, if available, along with any reference numbers if necessary.

- In Part II, check the certifications that apply concerning tax treaty benefits and provide details as required.

- In Part III, confirm your agreements regarding notional principal contracts and update statements as necessary.

- Complete Part IV by signing the form. Indicate the date and your capacity if you're signing on behalf of the beneficial owner.

- After filling out the form, save your changes, and choose to download, print, or share the form as needed.

Start completing your documents online today to ensure compliance and accuracy.

The Blank W8 form is typically filled out by foreign individuals or entities receiving U.S. source income. Anyone who does not have a U.S. tax identification number may be required to provide this documentation. Remember, using a service like USLegalForms can guide you through the process, ensuring you meet all necessary requirements and avoid common mistakes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.