Loading

Get State Specific - Revenue Delaware

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the State Specific - Revenue Delaware online

Filling out the State Specific - Revenue Delaware form can be a straightforward process if you follow the necessary steps. This guide aims to provide clear and concise instructions to help users navigate through the form with ease.

Follow the steps to successfully complete the form online.

- Use the ‘Get Form’ button to access the form and open it in a compatible editor.

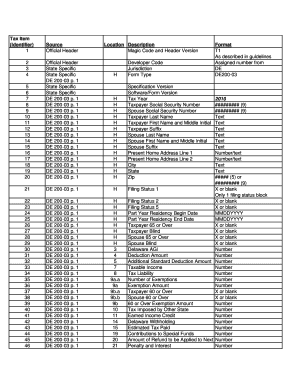

- Enter your taxpayer social security number in the designated field. Ensure this number is accurate to avoid processing delays.

- Fill in the taxpayer’s last name, first name, and middle initial. If applicable, include a suffix such as Jr. or Sr.

- Provide the spouse's information in the same manner as the taxpayer's details. If there is no spouse, you may leave this section blank.

- Complete your present home address, including both address lines if needed. Ensure the city, state, and zip code are correct.

- Indicate your tax year at the specified section. This is generally the year for which you are filing.

- Select your filing status from the available options. Only one filing status block should be marked.

- If applicable, provide details regarding part-year residency by indicating the begin and end dates using the MMDDYYYY format.

- Check the boxes for any applicable exemptions, such as being 65 or older or being blind.

- Enter your Delaware Adjusted Gross Income (AGI) along with any deductions and taxable income as directed.

- Complete the tax liability section accurately, adjusting for exemptions and credits as necessary.

- If applicable, report any tax imposed by other states or any earned income credits.

- Detail any Delaware withholding amounts and estimated taxes paid to ensure correct refund or balance due.

- For contributors to special funds, fill in the relevant sections to specify any contributions made.

- Once all the sections have been completed, review the form for accuracy.

- Save your changes, then use the options to download, print, or share the completed form.

Complete your State Specific - Revenue Delaware form online today for a smooth filing experience.

Delaware's combined state and local general revenues were $15.0 billion in FY 2021, or $14,950 per capita. National per capita general revenues were $12,277.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.