Loading

Get 2011 Form 2ec

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 Form 2ec online

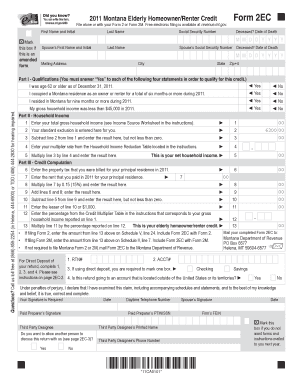

Filling out the 2011 Form 2ec online can be a straightforward process when you understand each section and its requirements. This guide provides step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to successfully complete the 2011 Form 2ec online.

- Press the ‘Get Form’ button to access the form and open it in the editing interface.

- Fill in your first name and initial, last name, and social security number in the designated fields. If applicable, include your spouse's information, marking the box if this is an amended form.

- Provide your mailing address, including city, state, and zip code.

- Complete Part I - Qualifications by answering 'Yes' to each of the four statements. This includes confirming your age, residency duration, and gross household income conditions.

- For Part II - Household Income, enter your total gross household income as per the guidelines. Utilize the Income Source Worksheet if needed to ensure accuracy.

- Proceed to Part III - Credit Computation, filling in the property tax billed and the rent paid during 2011. Calculate the applicable credit based on your net household income and the Credit Multiplier Table.

- Ensure you sign the form electronically. If applicable, include your spouse's signature and any signatures from paid preparers.

- Review the entire form for completeness and accuracy before proceeding to submit your claim electronically.

- Finally, choose to save changes, download a copy of the completed form, or share as required.

Complete your documents online today for a hassle-free filing experience!

To mail your Montana tax return, identify the correct address based on the type of return you are filing. The Montana Department of Revenue provides clear guidelines on where to send your completed forms. Make sure to double-check the address to avoid delays in processing. Using the 2011 Form 2ec can also guide you through properly filling out and mailing your return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.