Loading

Get Reset State Of Delaware 2011 Department Of Finance Division Of Revenue 820 N

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Reset STATE OF DELAWARE 2011 Department Of Finance Division Of Revenue 820 N online

Filling out the Reset STATE OF DELAWARE 2011 Department Of Finance Division Of Revenue 820 N form online can streamline the process of amending your eighth monthly withholding tax return. This guide will provide you with clear, step-by-step instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to complete the form successfully

- Click ‘Get Form’ button to obtain the form and open it in the editor.

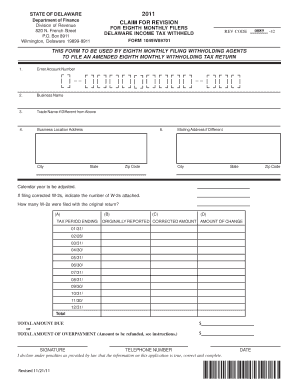

- In the first field, enter your account number. This number is crucial for identifying your business in the tax system.

- Next, provide your business name in the designated field.

- If your trade name differs from your business name, enter it in the appropriate section.

- Fill out the business location address, including the city, state, and zip code.

- If your mailing address is different, complete the mailing address section with the same details: city, state, and zip code.

- Indicate the calendar year you are adjusting.

- If you are filing corrected W-2 forms, specify how many W-2s are attached. Also, indicate how many W-2s were filed with the original return in sections A and B.

- Complete the tax period ending sections by filling out the originally reported, corrected amount, and the amount of change for each month listed from January to December.

- Calculate the total amount due or overpayment (amount to be refunded) and enter this in the corresponding field.

- Sign the form and provide your telephone number.

- Declare the accuracy of the information by confirming it is true, correct, and complete.

- Finally, save your changes, and download, print, or share the completed form as needed.

Complete your documents online today for a smoother filing experience.

Where's My State Tax Refund – Delaware. Refunds from Delaware tax returns generally take 10 to 12 weeks to process. For more specific status updates, visit the state's Refund Inquiry (Individual Income Tax Return) page. You will need to enter your SSN and your refund amount.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.