Loading

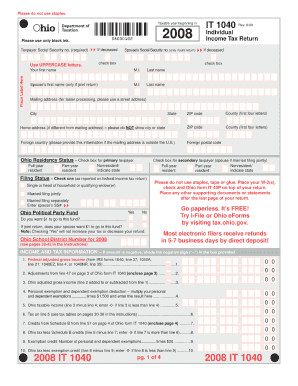

Get Ohio 1040 Instructions Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ohio 1040 Instructions Form online

Filling out the Ohio 1040 Instructions Form online can simplify the tax preparation process and help ensure accuracy. This guide provides clear, step-by-step instructions to assist users in completing the form efficiently and correctly, regardless of their experience level.

Follow the steps to complete the Ohio 1040 Instructions Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information in the designated fields. This includes your name, address, and Social Security number. Ensure that all information is accurate to avoid processing delays.

- Next, move to the income section of the form. Report all sources of income, including wages, salaries, and any other earnings. It is essential to include accurate figures to prevent discrepancies.

- Proceed to deductions and credits. Review the available deductions that you may qualify for. Fill in the applicable fields to ensure you maximize your tax benefits.

- Complete the tax calculations section. Follow the instructions carefully to compute your total tax liability based on the information provided earlier in the form.

- Review the form thoroughly. Check for any errors or omissions to ensure that all information is complete and accurate.

- Once you are satisfied with the completed form, you can save your changes, download a copy, print it for your records, or share it as needed.

Start filling out your Ohio 1040 Instructions Form online today to streamline your tax filing process.

You can obtain form 1040 instructions directly from the IRS website or by downloading them as a PDF. These instructions are also available via uslegalforms, where you can access the Ohio 1040 instructions form. This platform offers additional resources to assist you with filling out your tax forms accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.