Loading

Get 1040a Facts Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1040a Facts Form online

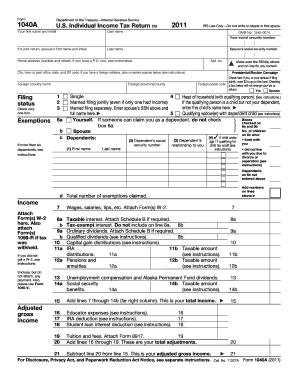

Filling out the 1040a Facts Form online can be a straightforward process when guided correctly. This guide provides clear, step-by-step instructions to help users complete their tax form accurately and efficiently.

Follow the steps to complete the 1040a Facts Form online.

- Click the ‘Get Form’ button to obtain the form and open it using the available online editor.

- Begin by entering your personal information in the required fields, including your first name, last name, and social security number. If you are filing jointly, make sure to provide your partner's information as well.

- Fill in your home address details accurately. If applicable, ensure to include your apartment number and ZIP code.

- Select your filing status by checking the appropriate box. For joint returns, make sure to include your partner's name in the provided field.

- Complete the exemptions section by entering the number of dependents and ensuring all information is accurate, including social security numbers.

- Proceed to the income section and record your earnings, including wages, interest, and any other relevant income data, as shown on your W-2 and any 1099 forms.

- Enter any applicable adjustments to your income, such as educator expenses or deductions for student loans.

- Calculate your adjusted gross income based on the provided guidelines.

- Follow through the tax credits and deductions sections, checking boxes where necessary, and ensuring accurate calculation of your taxable income.

- Ensure to review all entries for accuracy and completeness before saving your form. Once completed, you can save changes, download, print, or share the form as required.

Complete your 1040a Facts Form online today to ensure a smooth tax filing experience!

Related links form

Certain business expenses are 100% deductible, including some advertising costs, office supplies, and travel expenses directly related to business activities. Understanding which expenses qualify can help you maximize your tax benefits. Utilizing platforms like US Legal Forms can guide you through identifying and claiming these deductions properly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.