Loading

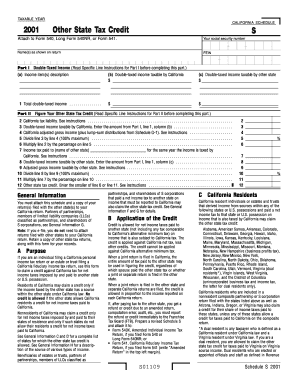

Get Reset Form Print And Reset Form Taxable Year California Schedule 2001 Other State Tax Credit S

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Reset Form Print And Reset Form TAXABLE YEAR CALIFORNIA SCHEDULE 2001 Other State Tax Credit S online

This guide provides clear and professional instructions on completing the Reset Form Print And Reset Form TAXABLE YEAR CALIFORNIA SCHEDULE 2001 Other State Tax Credit S. Designed for users of all experience levels, it will help you navigate each section of the form effectively.

Follow the steps to complete your form accurately.

- Click the ‘Get Form’ button to obtain the form and open it in your chosen online editor.

- Provide your social security number and your name(s) as shown on your return in the designated fields.

- In Part I, list any double-taxed income. In column (a), describe each income item, such as wages or partnership income.

- In column (b), enter the amount of double-taxed income taxable by California.

- In column (c), input the double-taxed income that is taxable by the other state.

- Total the amounts from columns (b) and (c) and ensure that you transfer these totals to line 1.

- In Part II, figure your Other State Tax Credit by following the specific line instructions carefully.

- Complete the calculations as directed, such as dividing your California tax liability by your adjusted gross income.

- For each line, carefully maintain accuracy to ensure correct credit calculation.

- Once you have finished filling out the form, review it for accuracy before saving your changes.

- Finally, download, print, or share the completed form as needed.

Complete your documents and submit them online today!

Purpose. If you are an individual filing a California personal income tax return or an estate or trust filing a California fiduciary income tax return, use Schedule S to claim a credit against California tax for net income taxes imposed by and paid to another state or U.S. possession.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.