Loading

Get Ffelp Unemployment Deferment Request Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ffelp Unemployment Deferment Request Fillable Form online

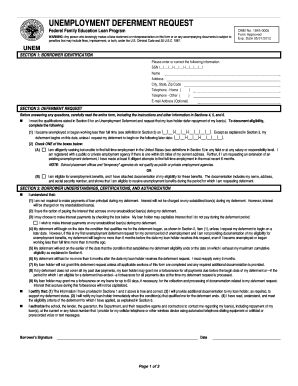

Completing the Ffelp Unemployment Deferment Request Fillable Form online is a critical step for individuals seeking to postpone loan repayment due to unemployment. This guide provides clear instructions to help users navigate each section of the form efficiently.

Follow the steps to successfully complete the Ffelp unemployment deferment request form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- In Section 1, provide accurate borrower identification details. Fill in your social security number, name, address, city, state, zip code, and optional email address. Ensure the information matches what is on file with your loan holder.

- For Section 2, state your eligibility for the deferment by entering the date you became unemployed or started working less than full time. Choose between the two options provided (A or B) to document your qualifications.

- In Section 3, review the borrower understandings and certifications. Confirm that you understand the terms of the deferment and check the box if you wish to make interest payments on your unsubsidized loans during the deferment period.

- Section 4 contains instructions for completing the form. Make sure to follow these guidelines regarding formatting and required documentation if qualifying through unemployment benefits.

- After completing the necessary sections, review all provided information for accuracy and completeness. Attach any supporting documents as required.

- Once the form is filled out, save your changes, and choose whether to download, print, or share the form according to your needs.

Start completing your Ffelp Unemployment Deferment Request Fillable Form online today!

Submitting a FAFSA deferment form involves accessing your FAFSA account online. If you qualify for deferment based on your financial situation, you can fill out the Ffelp Unemployment Deferment Request Fillable Form to support your application. Make sure to update your information accurately before submission. This will help ensure your eligibility for federal aid and deferment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.