Loading

Get 1098 - Idms (b)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1098 - IDMS (B) online

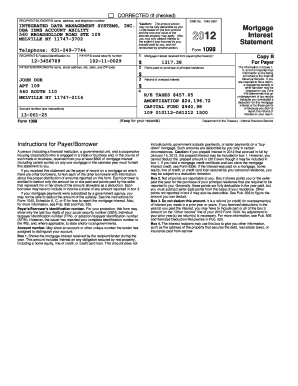

The 1098 - IDMS (B) is a critical tax form used to report mortgage interest paid and other related information to the Internal Revenue Service. This guide will assist you in accurately completing this form online, ensuring you understand each component and its relevance to your tax filing.

Follow the steps to complete the 1098 - IDMS (B)

- Press the ‘Get Form’ button to access the document and launch it in your preferred interface.

- Enter the recipient's/lender's name, address, and telephone number. This is the organization that provided you with the mortgage. Be sure to include the complete details accurately.

- Input the recipient's federal identification number. This number is essential for tax reporting purposes and should be verified for accuracy.

- Provide your social security number in the payer's section. Note that only the last four digits may be displayed for security yet the complete number is reported to the IRS.

- Fill out your name and address in the payer's/borrower's details section. Ensure that all information matches what is on official documents.

- In Box 1, enter the total mortgage interest received during the year. This figure should represent all interest paid on loans secured by real property.

- Complete Box 2 with the points you or the seller paid on the purchase of your principal residence. These may be partially deductible, so ensure to follow the guidelines of the tax code.

- Enter any refund of overpaid interest in Box 3. This is not deductible and must be reported as income if you itemized deductions in previous years.

- Use Box 4 for any additional information the lender wishes to provide, such as real estate taxes paid from escrow.

- Review all entered information for accuracy. Once confirmed, save your changes. You will also have the option to download, print, or share the completed form as needed.

Complete your 1098 - IDMS (B) online today and ensure your tax filings are accurate and timely.

If you cannot find your 1098 form, start by checking your email and physical records. If it’s not there, contact your lender or educational institution to request a duplicate. They can often provide it directly, or give you access to an online version. For more help, the US Legal Forms platform has resources to simplify your documentation search.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.