Loading

Get How To Fill Out De4 Worksheet B

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the How To Fill Out De4 Worksheet B online

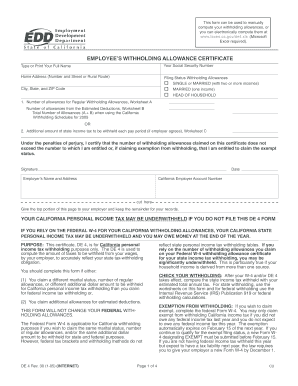

Filling out the How To Fill Out De4 Worksheet B is essential for determining your withholding allowances for California personal income tax. This guide provides a step-by-step approach to assist you in accurately completing the form online, ensuring that you meet your tax withholding obligations.

Follow the steps to accurately complete the form online.

- Click ‘Get Form’ button to access the worksheet and open it in your online editor.

- Enter your Social Security number in the designated field to ensure proper identification.

- Type or print your full name, followed by your home address, including the city, state, and ZIP code.

- Select your filing status by choosing one of the following options: Single or Married (with two or more incomes), Married (one income), or Head of Household.

- Fill in the number of allowances for regular withholding allowances from Worksheet A, and separately enter any allowances from the estimated deductions on Worksheet B.

- Calculate the total number of allowances by adding those from both worksheets and enter that total in the provided field.

- If applicable, enter the additional amount of state income tax you wish to have withheld each pay period.

- Sign and date the form to certify that the information provided is accurate and reflects your withholding allowances.

- Save your changes, and upon completion, download, print, or share the form as needed. Ensure you give the top portion to your employer and keep the remainder for your records.

Complete your forms online to stay compliant with your tax withholding needs.

The estimated deduction worksheet B is used to calculate potential deductions for your state taxes. It assists in projecting your tax liability and can inform your withholding decisions. By mastering how to fill out DE4 Worksheet B, you can ensure that your calculations align with your financial goals, making tax season less stressful.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.