Loading

Get Ri 1040x 2011 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ri 1040x 2011 Form online

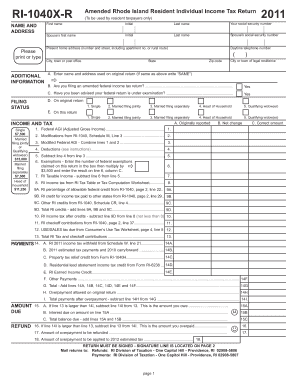

Completing the Ri 1040x 2011 Form online is an essential task for residents of Rhode Island who need to amend their income tax returns. This guide provides clear, step-by-step instructions to help users accurately fill out this form with ease.

Follow the steps to complete your online Ri 1040x 2011 Form.

- Click ‘Get Form’ button to obtain the Ri 1040x 2011 Form and open it in your preferred document editor.

- In the 'Name and Address' section, provide your last name, social security number, and spouse's information if applicable. Ensure that the daytime telephone number and current home address are correctly entered.

- For 'Additional Information', indicate the name and address as used on your original return. If the same, write “SAME”. Answer the questions regarding federal income tax return amendments.

- Indicate your filing status on your original and amended return by checking the appropriate option from the provided choices.

- Proceed to the 'Income and Tax' section, reporting your originally reported income and any modifications to calculate your modified federal AGI.

- Enter deductions based on the standard deduction amounts provided for your filing status. Subtract this from your modified AGI to determine your taxable income.

- Calculate your Rhode Island tax based on the RI tax table, input the amount of credits, and subtract these from your tax owed.

- Fill in the 'Payments' section, listing all relevant withheld taxes and credits. Calculate total payments and determine whether you owe balance or are due a refund.

- Complete the 'Refund' section if applicable, indicating the amount to be refunded or applied towards the next tax year.

- In 'Part 2', provide an explanation of any changes made to income, deductions, and credits as needed. Attach supporting documents if required.

- Ensure both you and your spouse (if applicable) sign the return on the designated signature lines.

- Finally, save your changes. You can download, print, or share the completed Ri 1040x 2011 Form as needed.

Start completing your Ri 1040x 2011 Form online today for a smooth filing experience.

In Rhode Island, there is no specific age at which you stop paying property taxes. However, certain exemptions may apply to seniors or disabled individuals that can significantly reduce their tax burden. It's advisable to review options in your local municipality to see if you qualify for any reductions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.