Loading

Get Georgetown Net Profit License Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Georgetown Net Profit License Tax Return online

This guide provides a clear and comprehensive walkthrough for users on how to accurately complete the Georgetown Net Profit License Tax Return online. By following these steps, individuals and businesses can ensure efficient filing of their tax returns.

Follow the steps to complete the Georgetown Net Profit License Tax Return online.

- Press the ‘Get Form’ button to access the Georgetown Net Profit License Tax Return and open it in the editor.

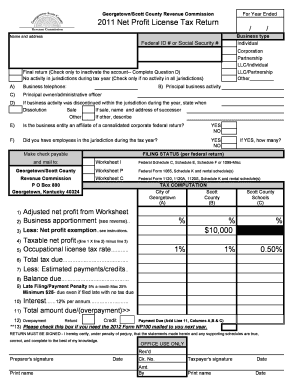

- Indicate your business type by selecting one from the options: Individual, Corporation, Partnership, LLC/Individual, LLC/Partnership, or Other. Fill in your federal ID number or Social Security number in the designated field.

- Complete your business information, including your name, address, and telephone number. Identify your principal business activity and principal owner or administrative officer.

- If applicable, state if your business activity was discontinued within the jurisdiction during the year. Specify the type of cessation—dissolution, sale, or other—and include relevant details.

- Answer the questions regarding your business's involvement with a consolidated corporate federal return and whether you had employees in the jurisdiction during the tax year.

- Proceed to calculate your adjusted net profit using the worksheets provided, including Worksheets I, P, and C as necessary. Input the figures in the appropriate lines of the tax computation section.

- Complete the tax computation by filling in your taxable net profit after deductions and calculating the total tax due. Don't forget to factor in any estimated payments or credits.

- Ensure to check for any penalties or interest that may be applicable and calculate the total amount due or overpayment accordingly.

- Once all sections of the form are filled out accurately, save your changes. You can then download, print, or share the completed Georgetown Net Profit License Tax Return as needed.

Complete your Georgetown Net Profit License Tax Return online to ensure a smooth filing process.

Your net income is usually found on the bottom line of your income statement on the Georgetown Net Profit License Tax Return. This line will show the final profit after all deductions are applied. It is crucial for determining your overall tax liability. If you need help identifying this line, consider using uslegalforms for assistance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.