Loading

Get 940 V Payment Voucher 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 940 V Payment Voucher 2019 online

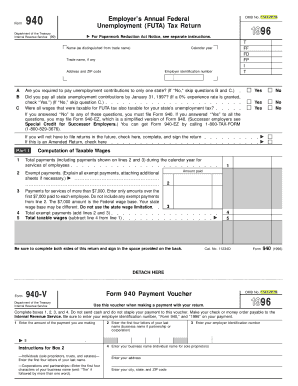

Filling out the 940 V Payment Voucher is an essential step for employers to ensure accurate submission of their federal unemployment tax return. This guide provides clear, step-by-step instructions to help users navigate the online form effectively.

Follow the steps to complete your payment voucher online efficiently.

- Press the ‘Get Form’ button to download the 940 V Payment Voucher form to your device.

- In box 1, enter the amount of the payment you are making. Ensure that the amount is accurate to avoid any issues with processing your payment.

- In box 2, provide the first four letters of your last name. If you are a business entity, use the first four letters of your business name, omitting any articles like 'The'.

- Enter your employer identification number in box 3. This number is crucial for the IRS to properly identify your tax submissions.

- For box 4, enter the business name. Sole proprietors should use their individual names, while corporations should use their business name.

- Include your address, city, state, and ZIP code after entering the business name to ensure the IRS has your correct contact information.

- Review all entries for accuracy. Ensure that all information is clearly legible and correctly entered before proceeding.

- Once you have completed the form, save your changes. You may then download, print, or share the form as needed.

Make sure to complete your documents online for a streamlined submission process!

Yes, you can paper file form 940, along with the 940 V Payment Voucher 2019. This method is often preferred by those who want to retain a physical copy of their submission. You can easily obtain the form through the IRS website or UsLegalForms, which provides comprehensive resources to assist with your filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.