Loading

Get Amending Tax Year Beginning , 19 And Ending , 19 Q

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Amending Tax Year Beginning, 19 And Ending, 19 Q online

Filling out the Amending Tax Year Beginning, 19 And Ending, 19 Q form online is a straightforward process. This guide will walk you through each step to ensure that you complete the form accurately and submit it successfully.

Follow the steps to complete your form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online document editor.

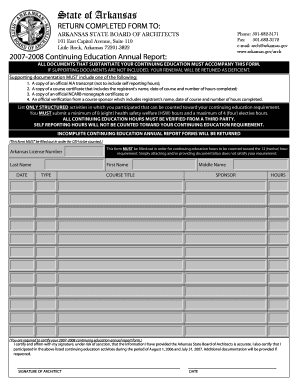

- Enter your Arkansas License Number in the designated field to identify your professional credentials.

- Fill in your Last Name, First Name, and Middle Name in their respective fields to personalize the form with your complete name.

- Provide the date of completion for the form in the specified date field.

- List the course titles you have completed in the 'COURSE TITLE' section, ensuring that they comply with continuing education requirements.

- Indicate the course sponsor in the 'SPONSOR' field to provide information about your education source.

- Record the hours completed for each course in the 'HOURS' section, noting the distinction between health safety welfare hours and elective hours.

- Review the certification statement and provide your signature in the designated space to affirm that the information entered is accurate.

- Finally, save your changes, and choose to download, print, or share the form as required for your records or further submission.

Take action now by completing your documents online to ensure your continuing education requirements are met.

Some taxpayers who are dual-status may have to file both Form 1040 and a 1040-NR in the same year. Dual-status taxpayers usually will file a Form 1040 for the portion of the year they were considered a US person and a Form 1040-NR for the portion of the year that they are considered to be a non-resident alien.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.