Loading

Get Fillable Dp 10

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fillable Dp 10 online

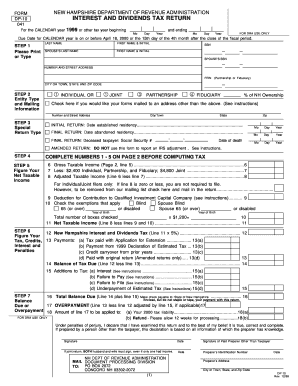

The Fillable Dp 10 form is a crucial document for reporting interest and dividends tax in New Hampshire. This guide offers a clear and user-friendly approach to successfully navigating and completing the form online.

Follow the steps to complete the Fillable Dp 10 seamlessly.

- Press the ‘Get Form’ button to obtain the Fillable Dp 10 and open it in the editor.

- Fill in your last name, first name, and initial, followed by your spouse’s last name and first name if applicable, as well as their social security numbers and your residential address.

- Indicate the entity type by checking the appropriate box: Individual, Joint, or Fiduciary Partnership. If you would like your forms mailed to a different address, specify it here.

- Select the special return type by checking the relevant box. If this is an initial, final, or amended return, provide the necessary dates.

- Complete the calculations for your net taxable income by following the instructions on page 2, ensuring to detail lines 1 through 8 accurately.

- Figure the New Hampshire Interest and Dividends Tax by multiplying the net taxable income by 5% and noting this on the form.

- Calculate any payments that have been made or taxes owed, completing the necessary lines for balance due or refund.

- Finally, ensure to sign and date the form. If filing jointly, both individuals must sign.

- Once completed, you can save your changes, download, print, or share the form online.

Start filling out your Fillable Dp 10 online today to ensure timely and accurate reporting of your interest and dividends.

The DP10 form is a valuable document that has specific uses in tax filings and financial reporting. By using the Fillable DP 10, you can simplify the process of preparing this form with accuracy. Our platform provides the tools needed to ensure you understand each section of the DP10 form, streamlining your filing experience.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.