Loading

Get Nebraska State Assessor Study Guide

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nebraska State Assessor Study Guide online

This guide provides clear instructions on how to complete the Nebraska State Assessor Study Guide online. Follow the steps outlined below to ensure you accurately fill out the required fields.

Follow the steps to complete your application smoothly

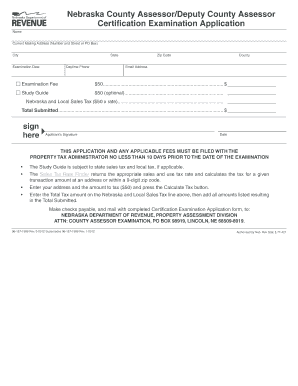

- Click ‘Get Form’ button to access the Nebraska State Assessor Study Guide and open it in the editor.

- Provide your full name in the designated field to ensure your application is correctly identified.

- Enter your current mailing address, including the number and street or PO Box, to ensure proper communication regarding your application.

- Specify the city and state associated with your mailing address.

- Select your preferred examination date from the available options.

- Fill in your daytime phone number to facilitate any necessary communication regarding your application.

- Provide the zip code linked to your mailing address for accurate location tracking.

- Indicate the county where you reside, which is essential for jurisdictional purposes.

- Enter your email address for digital correspondence related to the examination and application.

- Specify the examination fee of $50 in the appropriate field.

- If you choose to include the optional study guide, indicate its $50 cost in the designated section.

- Calculate any applicable Nebraska and local sales tax based on your residence address using the Sales Tax Rate Finder, and record it accordingly.

- Sum all amounts listed to arrive at the total submitted amount, which includes fees and taxes.

- Sign and date the application at the provided sections to certify your information.

- Finally, save your changes, ensuring you download or print a copy of your application for your records, and share it as necessary.

Ready to complete your application? Start filing the Nebraska State Assessor Study Guide online today!

In Nebraska, assessors generally need permission to enter private property for the purpose of assessment. However, state laws often grant them certain rights to view properties from public areas. If you have concerns, consulting with local officials can provide clarity on your rights. Utilizing the Nebraska State Assessor Study Guide might help you understand these rights better.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.