Get Louisiaa Tax Form L 4e

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Louisiana Tax Form L 4e online

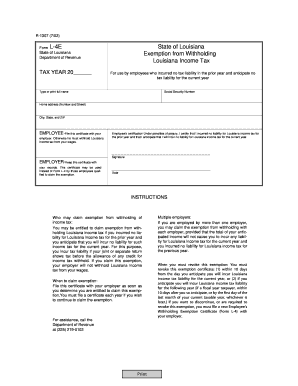

Filling out the Louisiana Tax Form L 4e online is a straightforward process that allows employees to claim exemption from Louisiana income tax withholding. This guide provides step-by-step instructions to help you complete the form accurately and easily.

Follow the steps to complete the Louisiana Tax Form L 4e online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your full name in the designated field. Make sure to type or print clearly to avoid any processing delays.

- Input your Social Security Number in the specified area to ensure proper identification.

- Provide your home address, including the number and street name, followed by the city, state, and ZIP code. Double-check that all information is accurate.

- Submit the employee portion by reading the certification carefully. You must confirm that you incurred no tax liability for the previous year and do not expect to incur any in the current year. Providing incorrect information could result in penalties.

- Sign and date the form where indicated. Your signature certifies the accuracy of the information provided.

- If applicable, ensure you adhere to the instructions regarding multiple employers, claiming the exemption with each as needed.

- Once all sections of the form are completed, you can save your changes, download, print, or share the form securely with your employer.

Complete your Louisiana Tax Form L 4e online today to ensure proper withholding exemptions.

The L-4E form in Louisiana is designed for individuals or entities seeking exemption from certain income tax amounts. Specifically, this form is often utilized for exemptions related to the activity of specific non-profit organizations and government entities. Understanding how the L-4E interacts with your financial obligations is vital for compliance and potential tax savings. For assistance, consider accessing detailed information through the US Legal Forms platform.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.