Loading

Get Sos Sc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sos Sc online

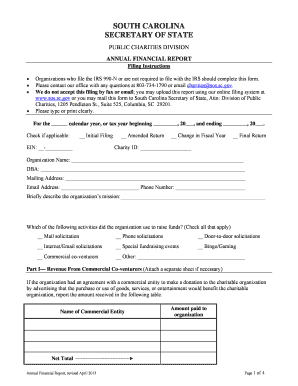

Filling out the Sos Sc form is an essential process for organizations looking to report their financial activities accurately. This guide will provide you with clear step-by-step instructions to complete the form online effectively.

Follow the steps to complete the Sos Sc form with ease.

- Press the ‘Get Form’ button to access the Sos Sc form and open it in your document interface.

- Fill in the calendar year or tax year beginning and ending dates as required in the designated fields. Make sure to double-check the years for accuracy.

- Indicate if the filing is an initial filing, amended return, change in fiscal year, or final return by checking the appropriate boxes.

- Enter your Employer Identification Number (EIN) and Charity ID in the provided spaces.

- Complete the organization name and any 'Doing Business As' (DBA) names in the respective fields, ensuring clarity and accurate representation.

- Fill in your mailing address, email address, and phone number to ensure your organization can be contacted regarding the report.

- Briefly describe your organization’s mission in the section provided, aiming for clarity and concise language.

- Select all applicable activities used by your organization for fundraising by checking the relevant boxes and describing any other activities as needed.

- Complete the revenue sections, detailing all fundraising events and gaming activities using the provided tables. Attach additional sheets if necessary.

- Input your organization's revenue from various sources in the designated section, ensuring to report noncash contributions at their fair market value.

- Detail your program service expenses and management/general fundraising expenses in the respective areas, providing clarity on each expense.

- Fill out the balance sheet details, capturing total assets and liabilities accurately.

- Ensure that the form is signed by both the Chief Executive Officer and the Chief Financial Officer of the organization. If one person holds both positions, they should sign in both areas.

- Review all entered information for accuracy before submitting the form. You can choose to save your changes, download, print, or share the completed form as needed.

Complete your Sos Sc form online today to ensure timely and accurate reporting for your organization.

Yes, you can set up an S Corp yourself, but it's important to understand the necessary steps and paperwork involved. You'll need to file Articles of Incorporation in South Carolina and then elect S Corp status with the IRS. While the process is straightforward, mistakes can lead to compliance issues. Using a service like US Legal Forms can help you navigate the requirements efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.