Loading

Get Going Out Of Business Sale Permit Application - Hcad

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Going Out Of Business Sale Permit Application - Hcad online

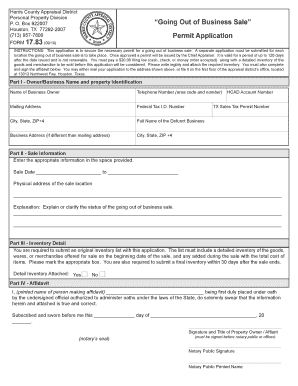

Filling out the Going Out Of Business Sale Permit Application is essential for any business looking to close operations and sell off their inventory. This guide will provide clear steps to complete the form online, ensuring users have the necessary information readily available.

Follow the steps to successfully complete your permit application.

- Select the 'Get Form' button to access the application form and open it in your chosen digital platform.

- Part I - Owner/Business Name and Property Identification: Enter the required details, including your name as the business owner, contact telephone number, mailing address, and federal tax identification number. Ensure you provide the correct business and sales tax permit numbers.

- Part II - Sale Information: Fill out the sale dates indicating when the going out of business sale will start and end. Include the physical address of the sale location and clearly explain the reasons for the sale.

- Part III - Inventory Detail: Create and attach a detailed inventory list that enumerates the goods to be sold, including their total costs. Ensure it’s original and comprehensive.

- Part IV - Affidavit: Complete the affidavit by printing your name and signing it in front of a notary public to validate the information provided in the application.

- Review all information for accuracy, then proceed to save your changes. You can download, print, or share the completed application as needed.

Begin the process of filling out your going out of business sale permit application online today.

To cancel a business license in Los Angeles, you need to submit a request to the Los Angeles Office of Finance. You may have to fill out Form BTRC-200 and provide your business information. If you're going through a closure, remember to look into a Going Out Of Business Sale Permit Application - Hcad so you manage the cessation properly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.