Get Texas Tax Excempt Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Texas Tax Exempt Form online

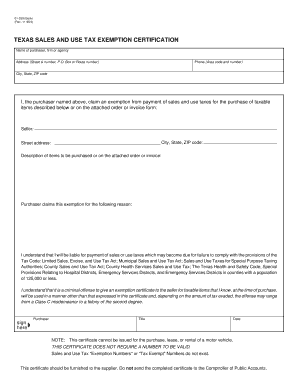

Filling out the Texas Sales and Use Tax Exemption Certification form online can streamline the process of claiming tax exemptions for eligible purchases. This guide provides clear, step-by-step instructions to help users navigate each section of the form effectively.

Follow the steps to complete your Texas Tax Exempt Form online.

- Click ‘Get Form’ button to access the Texas Tax Exempt Form and open it in your preferred document editor.

- In the first section, enter the name of the purchaser, firm, or agency in the designated field. Make sure to provide the full and correct legal name to avoid any complications.

- Next, fill in the address of the purchaser. This should include the street address, P.O. Box (if applicable), and route number, followed by the city, state, and ZIP code.

- Provide a contact phone number including the area code. This allows for any necessary follow-up regarding your tax exemption request.

- Identify the seller's information by detailing their name, city, state, and their ZIP code, followed by the seller's street address.

- In the section labeled 'Description of items to be purchased,' outline the taxable items you intend to buy. Ensure that the description matches what is provided on any attached orders or invoices.

- Indicate the reason for claiming the exemption in the designated area. Be clear and concise in stating your reasons to support your claim.

- Read through the compliance notice provided in the form and acknowledge that you understand the responsibilities associated with the exemption.

- Sign and date the form at the indicated areas to validate your claim. Ensure your signature matches the name of the purchaser.

- Once you have filled out all the required fields, you can save your changes, download, print, or share the completed form as necessary. Remember to furnish the final certificate to the supplier and do not submit it to the Comptroller of Public Accounts.

Start completing your Texas Tax Exempt Form online today for a hassle-free experience.

To fill out a W-4 form for tax-exempt status, mark the appropriate box indicating your tax exemption eligibility. Include personal information and complete the rest of the form as required. It's critical to provide accurate details to ensure compliance with tax laws. For comprehensive assistance, US Legal Forms can provide templates and instructions to help you navigate filling out your W-4 correctly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.