Loading

Get Form M 4p

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form M 4p online

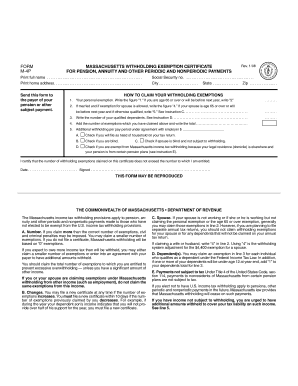

Filling out the Form M 4p is an important step in managing your Massachusetts income tax withholding for pensions and other payments. This guide will provide clear, step-by-step instructions to assist you in completing the form accurately and efficiently.

Follow the steps to complete the Form M 4p online seamlessly.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred online editing tool.

- Print your full name in the designated field. Make sure to use your legal name as it appears on official documents.

- Enter your home address, ensuring that all details such as street, city, state, and zip code are accurate.

- Provide your Social Security number in the assigned space, as this is a critical identifier for tax purposes.

- Understand the section on personal exemptions. If you are age 65 or over, write ‘2’; otherwise, write ‘1’.

- If you are married and eligible for exemptions for your spouse, enter ‘4’ for spouse exemptions, or ‘5’ if your spouse is age 65 or over.

- List the number of qualifying dependents on the form, following the instructions provided.

- Add together the exemptions you claimed above and write the total in the specified section.

- Indicate any additional withholding per pay period based on your agreement with your employer, if applicable.

- Review the optional checkboxes regarding filing status, blindness, and exemption from Massachusetts tax withholding. Tick the relevant boxes if you qualify.

- Date the form and sign it in the provided space, certifying that your claimed exemptions are accurate.

- Finally, save your changes, and then opt to download, print, or share the completed form as needed.

Complete your documents online to manage your tax obligations effectively.

In Massachusetts, you may avoid underpayment penalties if you meet specific criteria, such as having a tax liability under a certain amount or if your withholding covers your tax due. It’s essential to keep track of your payments and relative exemptions. Understanding how the Form M 4p interacts with these penalties can help you navigate your tax obligations efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.