Loading

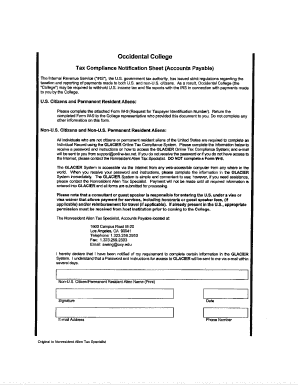

Get Tax Compliance Notification Sheet Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Compliance Notification Sheet Form online

This guide provides a detailed walkthrough on how to effectively complete the Tax Compliance Notification Sheet Form online. By following these steps, users will ensure they submit accurate and necessary tax information leading to successful compliance.

Follow the steps to fill out the Tax Compliance Notification Sheet Form online.

- Click the ‘Get Form’ button to obtain the form and open it in your chosen editor.

- Review the introduction section of the form which outlines the importance of tax compliance. Understand your classification based on whether you are a U.S. citizen or a non-U.S. citizen.

- For U.S. citizens and permanent residents: Complete the attached Form W-9. Input your name as shown on your income tax return. Ensure that your identification number (TIN) is entered correctly in the appropriate box.

- For non-U.S. citizens: Follow instructions specific to non-resident aliens. Complete the Individual Record using the GLACIER online tax compliance system. Ensure you have received your password and are ready to enter your information.

- Fill out all required fields meticulously, including your address and any optional account numbers. Make sure to classify your federal tax classification correctly by checking the appropriate box.

- Certify your taxpayer identification number (TIN) by signing and dating the form at the indicated section. This ensures you comply with declaring your tax status.

- Once all sections are completed, review the form to ensure all information is accurate. Saving changes is also essential.

- Finally, download, print, or share your completed form as required to submit it to the appropriate representative at Occidental College or through your chosen submission method.

Complete your Tax Compliance Notification Sheet Form online to ensure timely and accurate processing.

An income tax notice may arise from several issues, including underreporting income, missing forms, or discrepancies between your returns and IRS records. These notices serve to inform you of actions needed to rectify your tax situation. You can manage your responses better with a Tax Compliance Notification Sheet Form, ensuring you track necessary documents and deadlines.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.