Loading

Get Irs Form 720c

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs Form 720c online

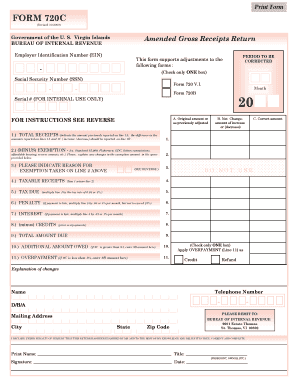

Filling out the Irs Form 720c is crucial for anyone needing to amend their gross receipts return. This guide will provide clear, step-by-step instructions for completing the form online, ensuring a smooth filing process.

Follow the steps to accurately complete your Irs Form 720c online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your Employer Identification Number (EIN) or Social Security Number (SSN) in the designated field.

- Check the appropriate box indicating the type of return you are amending, and enter the month of the return if applicable.

- In Line 1, report your total receipts as follows: column A for the original amount, column B for any adjustments, and column C for the corrected total.

- In Line 2, input the original exemption amount in column A and any adjustments in column B, followed by the correct exemption in column C.

- In Line 3, indicate the reason for the exemption taken earlier by entering the corresponding code from the list provided.

- Calculate your taxable receipts in Line 4 by subtracting line 2 from line 1 for each column.

- In Line 5, multiply the taxable receipts from line 4 by the tax rate of 0.04 or 4% to determine the tax due.

- Calculate the penalty due in Line 6; multiply the tax due from line 5 by 5% for each month past due, up to a maximum of 25%.

- Determine the interest due in Line 7 by multiplying the tax due from line 5 by 1% for each month past due.

- In Line 8, enter any credits from prior payments.

- Sum your totals in Line 9 by adding lines 5, 6, and 7, and then subtract line 8.

- If line 9C exceeds 9A, enter this amount on line 10; if less, enter the amount on line 11 and check the appropriate box for credit or refund.

- Use the section for 'Explanation of changes' to clarify any adjustments made.

- Complete the bottom section with your name, title, address, and daytime phone number. Ensure you sign and date the return.

Take the first step towards completing your Irs Form 720c online today.

A form 720 correction involves submitting an amended IRS Form 720c when you discover errors in your original submission. This correction helps maintain compliance and accuracy in your tax reporting. If you need assistance with corrections, platforms like US Legal Forms can provide templates and advice to streamline the process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.