Loading

Get Form 72a072 8 05

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 72a072 8 05 online

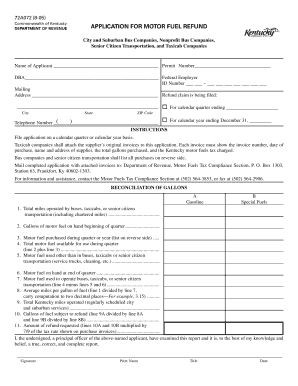

Filling out the Form 72a072 8 05 online is a straightforward process for applicants seeking a motor fuel refund. This guide provides step-by-step instructions to assist you in completing the form accurately and efficiently.

Follow the steps to successfully fill out the form.

- Click ‘Get Form’ button to access the form and open it in the appropriate editor.

- Begin by entering your name in the 'Name of Applicant' field and ensure your permit number is entered correctly in the corresponding space.

- Fill out the 'DBA' (Doing Business As) name if applicable, followed by your Federal Employer ID number using the specified format.

- Provide your complete mailing address, including city, state, and ZIP code to ensure correspondence reaches you without delay.

- Indicate whether you are filing a refund claim for the calendar quarter ending or the calendar year ending December 31 by checking the appropriate box.

- Enter your telephone number in the designated field to facilitate communication regarding your application.

- Complete the reconciliation of gallons by entering the total miles operated, gallons of motor fuel on hand, and purchases made during the quarter or year.

- Calculate and fill in the total motor fuel available for use, as well as the motor fuel used for purposes other than operating buses or taxicabs.

- Determine the average miles per gallon and complete the calculations for gallons of fuel subject to refund.

- In the final part of the form, sign and print your name, as well as provide your title and date, confirming the accuracy of the information submitted.

- Once all fields are completed, you can save the changes, download, print, or share the form as required.

Complete your form online today for a smooth filing experience.

You can get the W-8BEN tax form by visiting the IRS website or authorized platforms that provide tax forms. Online legal service providers like USLegalForms not only offer the W-8BEN form but also ensure you understand how to complete it properly. This can ease your journey when dealing with formalities regarding Form 72a072 8 05.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.