Get Filling Out An St 1192 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Filling Out An St 1192 Form online

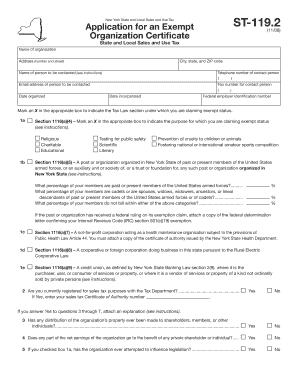

Filling out the St 1192 form is a crucial step for organizations seeking an exempt organization certificate in New York. This guide provides step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to successfully complete the St 1192 form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of your organization in the designated field. Ensure the name matches your official registration documents.

- Indicate the date your organization was formed and the date it was incorporated in the relevant fields.

- Input your Federal Employer Identification Number (EIN). This number is essential for tax identification.

- In section 1116(a)(4), check the boxes that represent the specific purpose for your exemption claim, such as religious, charitable, or educational.

- Respond to the questions regarding your organization's activities, providing an explanation if necessary, and ensure to answer truthfully all Yes/No questions.

- Compile and attach the required statements of activities, receipts and expenditures, as well as assets and liabilities as directed on the application.

- After completing the form, save any changes you made, download a copy for your records, and print or share the final document as needed.

Start filling out your St 1192 form online today for a more efficient application process.

To obtain a Kansas sales tax exemption certificate, you must first apply through the Kansas Department of Revenue. This process involves providing necessary documentation that supports your exemption status. Once approved, you’ll receive your certificate, which will be essential for claiming exemption during purchases. If you need guidance on filling out related forms like the ST 1192 Form, US Legal Forms is a valuable resource.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.