Loading

Get Ameritrade Terms Of Withdrawal Pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ameritrade Terms Of Withdrawal Pdf online

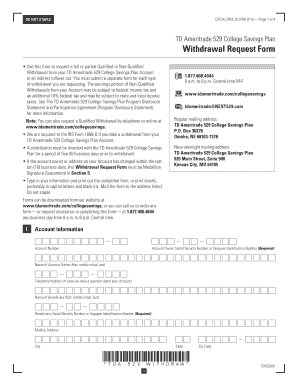

Filling out the Ameritrade Terms Of Withdrawal Pdf is an essential step for anyone looking to withdraw funds from their TD Ameritrade 529 College Savings Plan account. This guide provides clear and supportive instructions to help you complete the form accurately and efficiently.

Follow the steps to complete your withdrawal request.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill out your account information in the designated fields, including your Social Security Number or Taxpayer Identification Number, account number, and the account owner's name. Ensure that your contact information is accurate.

- Select the reason for your withdrawal by choosing one of the six options available. Be sure to review the definitions provided in the Program Disclosure Statement to make an informed choice.

- Indicate the amount of withdrawal you are requesting. You can choose to withdraw the full balance or specify a partial amount. Ensure that the information is clear and precise.

- Review the signature section to ensure understanding of the terms. Sign and date the form, affirming that the information you provided is accurate.

- If you have experienced a change of account ownership or address within the last ten business days, complete the Medallion Signature Guarantee section as required.

- Save your changes once the form is completely filled out. You can then choose to download, print, or share the completed form as needed.

Complete your Ameritrade withdrawal request forms online today for a smooth transaction process.

No, TD Ameritrade has not gone away. The platform continues to operate and provide investing services to its customers. Stay updated on their offerings, including the Ameritrade Terms Of Withdrawal PDF, which details essential withdrawal processes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.