Loading

Get 401k Statement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 401k Statement online

Filling out the 401k Statement online can be a straightforward process when you understand each section and its requirements. This guide will provide you with clear, step-by-step instructions to ensure that your application is completed accurately and efficiently.

Follow the steps to complete your 401k Statement online.

- Click ‘Get Form’ button to access the 401k Statement and open it in your editor.

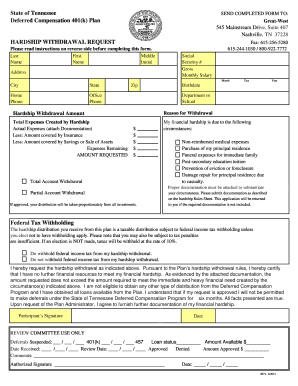

- Enter your personal information in the fields provided. This includes your last name, first name, middle initial, social security number, home address, city, state, zip code, home phone, office phone, and date of birth. Ensure all information is accurate to avoid delays.

- Indicate your department or school where you are employed. This is essential for processing your withdrawal request.

- Select your reason for withdrawal from the provided options. It's important to choose the option that best reflects your financial hardship.

- Enter the hardship withdrawal amount you are requesting and list any total expenses resulting from the hardship. Include your actual expenses, ensuring you attach the required documentation to substantiate your claims.

- Provide details on any amounts covered by insurance or savings. This helps in calculating the remaining expenses.

- Complete the federal tax withholding section by selecting whether you want taxes withheld from your hardship withdrawal. Note that if you opt-out of withholding, it's important to be aware of potential tax penalties.

- Review your completed application. Make sure all information is accurate and documentation is attached. Your application may be returned if it is incomplete.

- Sign and date the application, ensuring that your signature is notarized as required. This validates your request.

- Submit the completed form along with all supporting documents to Great-West at the specified address to begin processing your request.

- Finally, after submission, you can save changes, download a copy for your records, print the application, or share it as necessary.

Complete your 401k Statement online now for a smooth and efficient withdrawal process.

To fill a 401k, you need to enroll through your employer or an independent service provider. After enrollment, decide how much to contribute and choose your investment options. Monitoring your 401k statement will help you adjust contributions and investments as life changes, ensuring you're prepared for retirement.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.