Loading

Get Fica Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fica Form online

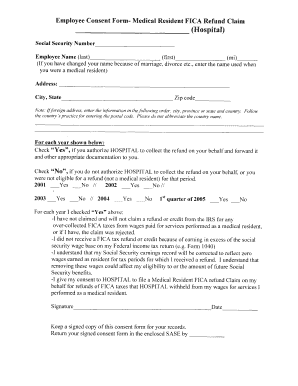

Filling out the Fica Form is an important step for medical residents seeking a refund of over-collected FICA taxes. This guide provides clear, step-by-step instructions to help users navigate the online form efficiently.

Follow the steps to complete the Fica Form online.

- Click ‘Get Form’ button to access the form and open it in your online editor.

- In the first section, enter your Social Security number to verify your identity.

- Fill out your name in the fields provided: last name, first name, and middle initial. If you have changed your name, please indicate the name you used during your residency.

- Complete your address details including street address, city, state, and zip code. For a foreign address, ensure you follow the format of your country for postal codes.

- For each year listed, check 'Yes' if you authorize the hospital to collect the refund on your behalf or 'No' if you do not authorize it or were ineligible for a refund.

- Affirm the statements regarding your claims for refund or credit from the IRS, ensuring that you have not claimed a refund for any over-collected FICA taxes.

- Provide your consent by signing the form where indicated, ensuring you understand the implications regarding Social Security benefits.

- Once all sections are correctly filled, save your changes. You may then choose to download, print, or share the completed form for your records.

Take action now by filling out your Fica Form online to ensure your eligibility for a refund.

Calculating your FICA is straightforward and involves applying a specific percentage to your gross earnings. For most employees, the FICA tax rate is currently set at 7.65%, which covers Social Security and Medicare. To simplify this process, you can use the Fica Form on uslegalforms, which provides clear calculations and ensures you stay compliant with tax regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.